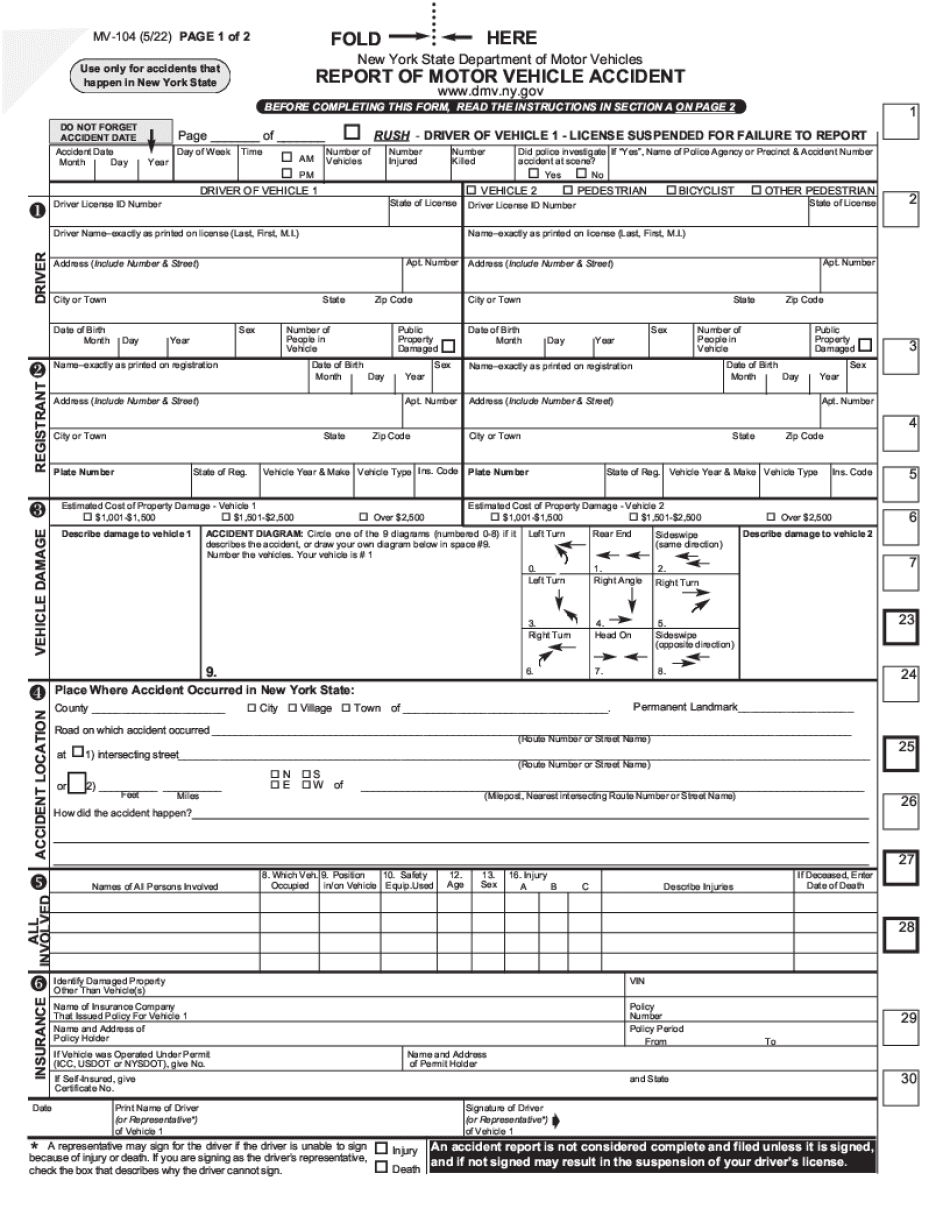

You must report any accident occurring in New York State that costs a fatality, personal injury, or property damage for any person involved, totaling more than one thousand dollars. Failure to do so within 10 days is a misdemeanor. Your license and/or registration may be suspended if you don't report the accident on time and according to the mv-104 form. At the Law Offices of William Mattar, we can walk you through the form and answer your questions. The mv-104 form has two sections, A and B. To get started, you will need a black ink pen, your driver's license, and vehicle registration. It is also helpful if you have a copy of the police report while completing the form. If any of the questions do not apply to your accident, you should put a dash mark on the line. If you don't know the correct answer, you should put an X on the line. The first step to completing the mv-104 form is reading the instructions provided on page 2, starting with section A labeled "Vehicle Involvement." Then, at the top of the form on page 1, enter in the date of the accident, including the day and time, along with the number of vehicles and people involved in the crash. You'll also need to write down the precinct number of the police agency if the police investigated the accident. This number should be on the police report. Next, enter all of your personal information in the "Driver's Information" section on page 1 as "Vehicle 1." Write down your driver's license number, name, address, birth date, and other requested information. The information you provide must match the information on your driver's license exactly. The other driver's information should be added directly across from your information. If you didn't exchange information at the scene...

Award-winning PDF software

NY 104 Form: What You Should Know

Registering the motor vehicle involved in the wreck or accident with the DMV — New York DMV if a car accident occurred on a New York State roadway or highway, the injured party must immediately contact the NY State Vehicle and Traffic Law Bureau (NV TLB) at the same office The NV TLB is responsible for registering and licensing vehicles in the state of New York and issuing registration tags. Report of Motor Vehicle Accident (MV-104) and Registration Form — New York DMV NV TLB requires at-fault driver's information from each vehicle involved in car accident. This information is needed by DMV to: to verify ownership (at-fault drivers' licenses) in order to determine whether to issue a temporary insurance license plate for the accident at-fault drivers' licenses and permanent disability license plates are required by New York Law unless the motor vehicle was inoperable at the time of the accident. Registration Form — New York DMV New York state provides the following two options for the owner of a motor vehicle involved in a car accident: 1. If the accident happens on NYS State Highway, such as STATE HIGHWAY or STATE HIGHWAY 1, you MUST register the vehicle with the NYS DMV within 60 days of the accident. This must be done before you can obtain a motor vehicle (MV) registration, or after you obtain the registration in order to renew it or apply for special insurance. 2. If the accident happened on private property, you MUST obtain a driver license from local law enforcement or from New York State in order to register the vehicle. At-fault license plates should not be applied for. The owner of a vehicle (the at-fault driver) must complete a Report of Motor Vehicle Accident (MV-104) and a registration plate application within 10 days after learning of the accident. In addition, if the at-fault driver is an occupant of the vehicle, the applicant must complete the New York State Driver License/ID Card Application (LIC-500) form to obtain a driver license. For information on this registration plate, click here. You can also visit the NYS DMV for further information. (Click here for details...

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do NY 104, steer clear of blunders along with furnish it in a timely manner:

How to complete any NY 104 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your NY 104 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your NY 104 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing NY 104